STUDENTS

25 Years of Hands-On Investing: The Crummer Truist Portfolio

Travel back to 1999 when SunTrust (now Truist) donated one million dollars to the Crummer Graduate School of Business at Rollins College. Half the money was used to build a then state-of-the-art auditorium. The other half of the money would be given in $100,000 increments to a specific fund for student use only. That’s right—the students would be managing real funds and getting true hands-on experience thanks to the efforts of Rollins President Rita Bornstein.

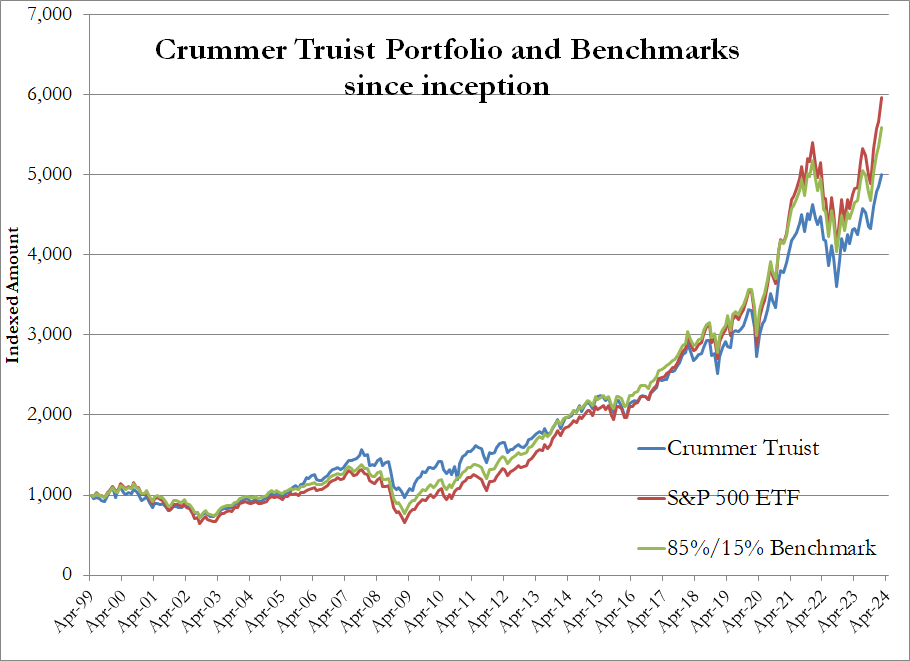

But student experience isn’t the only goal of the fund. Money made from the investments goes toward scholarships. Since 2005 (the year the fund began disbursements), more than $600,000 has been awarded in scholarships. The class where the students get this experience, FIN609 Managing Global Portfolios, is taught by Dr. Koray Simsek. “When I joined Crummer eight years ago, this was the thing that excited me the most,” he said. His guidance and lessons are going well. The fund is now at $1.25M, and that doesn’t include the scholarships disbursed. The fund’s annualized compound return over its 25-year history has been 6.7% per year.

An extra level of challenge for the students is that they only trade once a year, in early April. So they must spend months doing research and agreeing on their recommendations, then produce the final portfolio that is then shared with an oversight committee. The committee consists of local experts: industry practitioners, a member of Rollins College Board of Trustees, a Crummer faculty member, and a member selected by Vice President of Finance at Rollins. Their goal is oversight only, not direct portfolio management, but they do have the authority to make changes to the student recommendations if needed.

The group of students, called the Crummer Investment Management Team, has two tasks when creating their portfolio: focusing on the long-term investments and also the short-term (tactical) for the near term. These strategies align with the goal of safeguarding the portfolio’s value during market downturns and enhancing its value during upswings, all the while supporting scholarships, without causing a lasting erosion of principal value.

The students begin by examining the economic outlook for the year, analyzing inflation, interest rates, the labor market, supply chain issues, GDP, and unemployment. They analyze potential risks and catalysts for investment performance. And since 2019, there has also been a focus on environmental, social, and governance (ESG) investing. ESG ratings are used as a primary screening guide for potential investments. Investment recommendations are made in the areas of communication services, consumer discretionary, consumer staples, energy, financials, healthcare, industrials, information technology, materials, real estate, and utilities.

Once the recommendations have been put into place, the performance of the Crummer Truist Portfolio is compared to the S&P 500. As you can see below, for the past 25 years the Crummer students have done well at following the market trends.

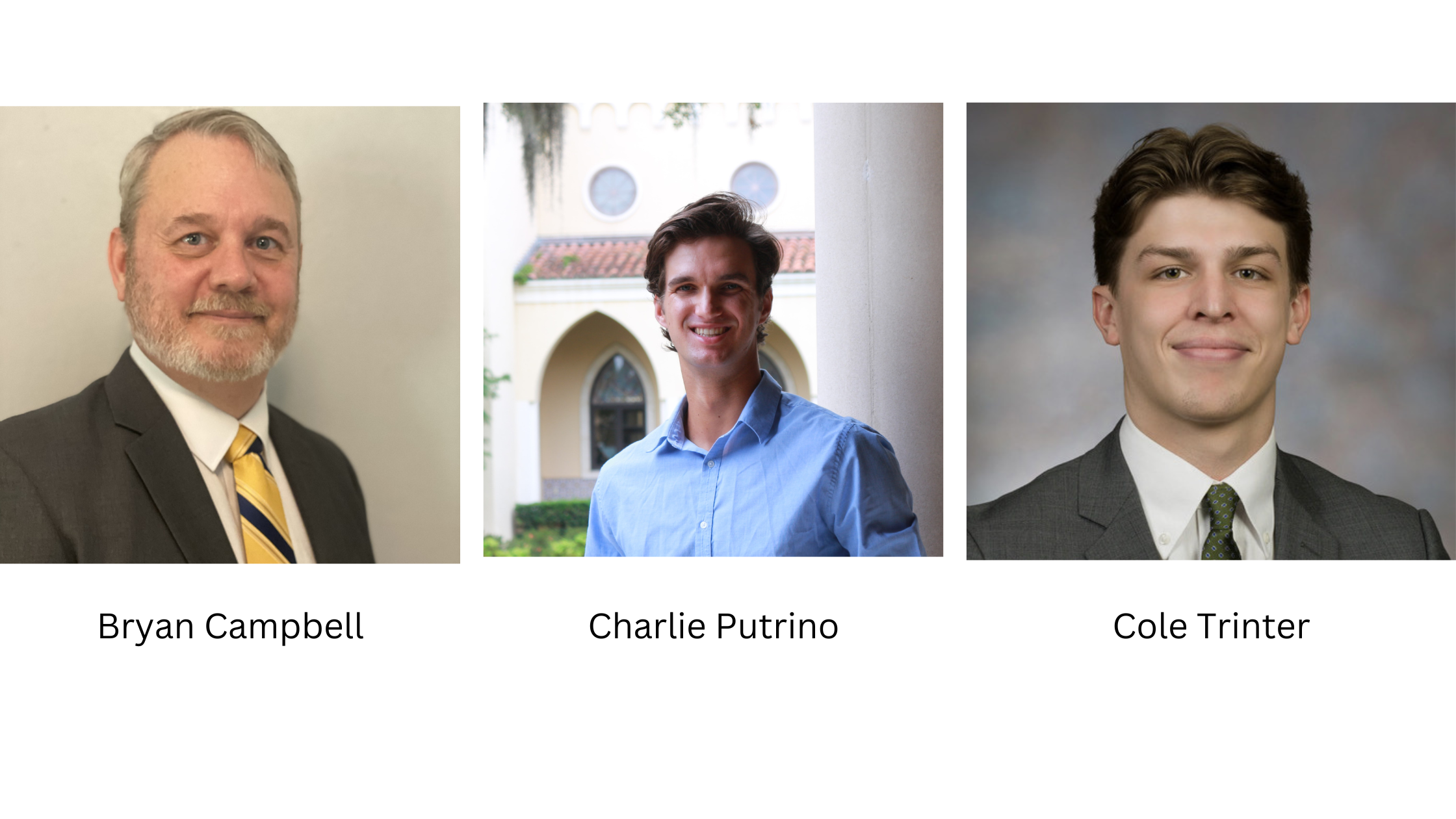

The Crummer Investment Management Team is a large one this year and consists of 17 members. The students enjoy the experience and appreciate the opportunity to get the hands-on practice. “The opportunity to gain real-life experience with financial markets and investment strategies is an invaluable experience, as it provides a practical application for the theoretical concepts learned in the classroom. This experience has sharpened my analytical skills and deepened my understanding of market dynamics, which will be invaluable in my future career in finance,“ said Charlie Putrino, a student on the team.

“As a woman in finance, this project has expanded my experience and enhanced my portfolio management skill set. Throughout, I learned how to better qualify investment opportunities, diversify portfolios, and manage risk. This course has exposed me to industry trends and investment strategies applicable to my desired career in Equity Research, for which I am grateful,” said Valeria Grisanti (pictured), another student on the team.

“As a woman in finance, this project has expanded my experience and enhanced my portfolio management skill set. Throughout, I learned how to better qualify investment opportunities, diversify portfolios, and manage risk. This course has exposed me to industry trends and investment strategies applicable to my desired career in Equity Research, for which I am grateful,” said Valeria Grisanti (pictured), another student on the team.

“I chose to partake in this project and class because it is the most applicable, real-world opportunity at Crummer to learn and apply the technical skills needed in the financial field. Individually impacting the Truist Portfolio while coming together weekly as a team in a classroom setting allows everyone to feel the added responsibility and importance of our work,” said Cole Trinter, another team member. The rest of the team members’ names can be found below.

The team this year will be releasing their portfolio with recommendations in April. Then it’s off to the oversight committee for review. The students’ hard work will hopefully pay off, and the fund will continue to grow as it has done for the past 24 years.

The 2024 Crummer Investment Management Team:

Ryan Astley

Bryan Campbell

Bridget Collis

Axel Einarsson

Caroline Gastonguay

Valeria Grisanti

Jay Kineon

Catherine Mitchell

Charlie Putrino

Nicholas Rojas

David Scupholm

Trevor Siemon

Lily Thornewill

Cole Trinter

Nick Villamil

Brad Vincent

Zane Williams

Does the Crummer Truist Portfolio as a component of the Crummer MBA sound interesting to you? Learn more about our programs at one of our upcoming info sessions here.